Unlocking Indonesia's "Aluminum": Exploring the Opportunities and Challenges of the Next Global Aluminum Industry Hub!

Release time:

2025-04-28

Over the past year, the Chinese aluminum processing industry has shown a mixed picture of development. On the positive side, total output has continued to grow, further consolidating its leading global position, and the applications of aluminum are constantly expanding. On the negative side, overcapacity and intensifying industry competition have led to a widespread phenomenon of "increased revenue but not increased profit," while the increasingly complex international trade environment further squeezes the export space for Chinese aluminum processing products. Against this backdrop, a sense of crisis that "those who don't go global will be eliminated" is spreading through the Chinese aluminum processing industry, with more and more aluminum processing companies actively seeking "global" value洼地.

Over the past year, the Chinese aluminum processing industry has shown a mixed picture of progress and challenges. On the positive side, total output has continued to grow, strengthening its leading global position, and the applications of aluminum are constantly expanding. However, concerns remain about overcapacity and intensifying industry competition, with the phenomenon of "increased revenue but not increased profit" becoming increasingly common. The increasingly complex international trade environment further restricts the export space for Chinese aluminum processing products. Against this backdrop, a sense of crisis that "those who don't go global will be eliminated" is spreading through the Chinese aluminum processing industry, and more and more aluminum processing companies are actively seeking "global" value洼地.

Meanwhile, Indonesia, an archipelago nation straddling the equator, is writing its own chapter in the global aluminum industry landscape. Indonesia is exceptionally rich in bauxite resources, ranking sixth globally in reserves, with approximately 1.2 billion tons, accounting for 4% of the global total, providing a solid foundation for the development of the aluminum industry chain. Furthermore, the Indonesian government's 2014 ban on raw ore exports further stimulated domestic aluminum companies to expand their production capacity overseas, attracting significant investment from Chinese aluminum companies such as Nanshan Aluminum, Huafeng Aluminum, and Weiqiao Group to build factories there.

01 Entering Jakarta: Unlocking Indonesia's "Aluminum"

Similar to the situation in China at the beginning of the 20th century, Indonesia is currently vigorously promoting infrastructure construction. Housing, roads, airports, high-speed rail, and industrial parks are emerging rapidly, creating a huge market for aluminum processing products and attracting the attention of many Chinese aluminum processing companies.

So, what is the true face of the Indonesian aluminum processing market? How are Chinese companies developing there? To gain a deeper understanding of these issues, the Aluminum Plus Network team embarked on a three-day "aluminum" search in Indonesia. We went deep into the Jakarta area, held discussions with companies in the local aluminum processing industry chain, and conducted on-site visits to several representative aluminum processing companies. These companies, some of which are Chinese investments and others founded by local Chinese, together constitute a vivid picture of Indonesia's aluminum processing industry and provide a strong reference for more domestic aluminum processing companies to "go global" to Indonesia in the future.

On the afternoon of April 25th, taking advantage of the groundbreaking ceremony for YinDa Technology's Indonesian production base, Aluminum Plus Network held an in-depth discussion with nearly 30 representatives from local aluminum processing industry chain companies in the Tangerang Park, including Pacific Aluminum, Jianye Energy Technology, Xinyao Aluminum, Inkasa, YinDa Technology, Dali Mould, Jianfa Aluminum, and Binakarya, sharing and exchanging views on the current situation and prospects of the aluminum processing industries in both countries.

Through the generous sharing of Indonesian aluminum processing companies, Aluminum Plus Network has gained a clear impression of the Indonesian aluminum processing industry: the Indonesian aluminum processing market is in a period of rapid development, with various types of companies able to find their own niche. A rough estimate suggests that there are 45 to 50 aluminum profile factories nationwide, with an estimated total annual production capacity of around 500,000 tons. Chinese and Chinese-funded companies, with their technological equipment and scale advantages, occupy a dominant position in Indonesia's aluminum processing industry, with leading companies including the Japanese company YKK and Alexindo, founded by local Indonesian Chinese. Local companies, relying on their deep understanding of the local market and mature sales networks, firmly hold the advantage in the mid-to-high-end market and enjoy good brand recognition. Newly established Chinese companies are developing rapidly in the mid-to-low-end and industrial materials sectors thanks to their technological and production capacity advantages. With the entry of more Chinese companies and the growth of local companies, Indonesia's aluminum processing industry is entering a new stage of greater diversification and specialization.

Visiting YinDa Technology: China's Powder Coating Leader in the Indonesian Market

YinDa Technology is a well-known domestic powder coating manufacturer. It entered the Indonesian market as early as 2013 and quickly became a leading company in the Indonesian powder coating industry, with a market share exceeding half, thanks to its high-quality and competitively priced products.

Mr. Zhao from YinDa Technology told Aluminum Plus Network that the mainstream doors and windows in the Indonesian market currently use powder-coated profiles. Domestic powder coatings are of good quality and are more competitively priced than imports from other countries, making them highly accepted in the Indonesian market, and market expansion is rapid.

As a supply chain company, YinDa Technology has also keenly felt the significantly accelerated pace of Chinese aluminum processing companies going global in recent years. To keep up with this wave of global expansion, YinDa Technology has also accelerated its overseas layout, and its new factory in Saudi Arabia is also planned to start construction this year.

Visiting Jianye Energy Technology: A Pioneer in Indonesian Photovoltaic Frames

Located in the Tangerang Industrial Park, Jianye Energy Technology is a wholly-owned subsidiary of Anhui Huasheng Aluminum Industry. Upon entering the company's factory area, the first thing that catches the eye is the well-equipped factory buildings and orderly production lines. The company has more than 200 employees, many of whom are senior engineers and technical personnel dispatched from China. They are mainly responsible for guiding local employees in operating equipment and controlling product quality.

Jianye Energy Technology is a leader in local photovoltaic frame profiles in Indonesia, with five extrusion production lines and full-chain production capabilities, from mold design, casting, extrusion, surface treatment to deep processing, with an annual production capacity of 20,000 tons. Mr. Chen, the company's head, told Aluminum Plus Network that the decision to expand to Indonesia was partly due to the fact that the local area is still a blank in the processing of aluminum profiles such as photovoltaic frames and brackets, and partly because the Indonesian government has been vigorously promoting photovoltaic power generation in recent years and has conducted in-depth cooperation with many domestic photovoltaic giants, resulting in a vast photovoltaic component market.

Currently, Jianye Energy Technology's products are mainly supplied to local Chinese photovoltaic companies in Indonesia, such as Zhengxin Photovoltaic, Trina Solar, and Lingshu Photovoltaic. To enhance production capacity and strengthen the advantages of aluminum products for photovoltaic applications, Jianye Energy Technology has purchased 80,000 square meters of land for the construction of a new factory, which is expected to start construction by the end of the year. At the same time, with the entry of domestic automakers such as BYD into Indonesia, Jianye Energy Technology will further expand into higher-end industrial profile areas such as new energy vehicles and rail transit in the future.

Visiting Xinyao Aluminum: Achieving Local Breakthrough Through a Diversified Brand Strategy

Xinyao Aluminum Indonesia is a young company established in 2022. The founder is an overseas Chinese from Fujian who has been based in Indonesia for over 20 years, operating in the building materials industry.

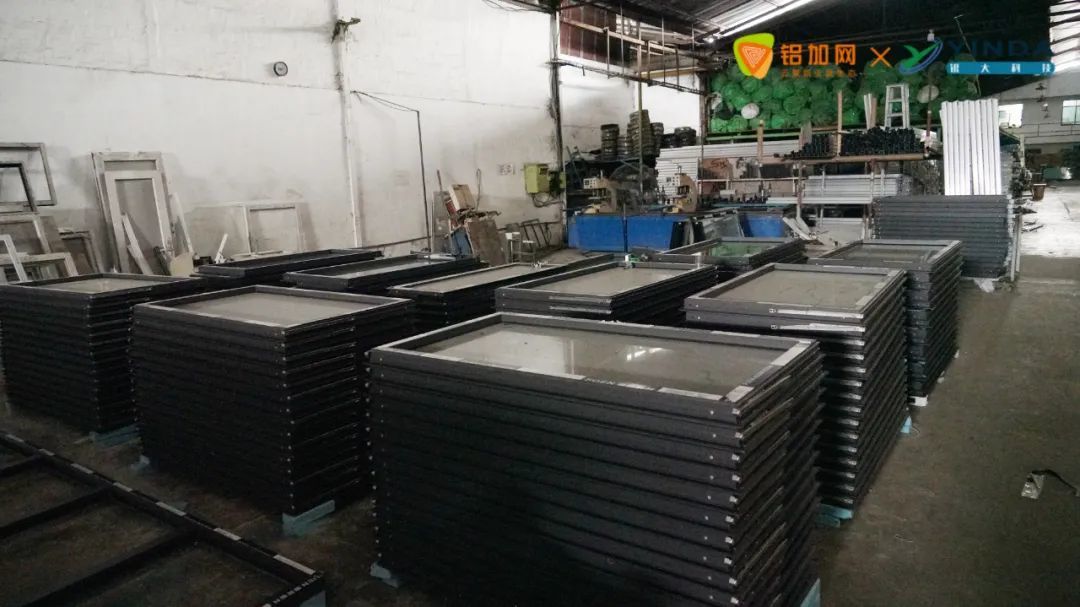

In its 22,000-square-meter factory, numerous employees are operating aluminum equipment imported from China. Mr. Wen, the company's head, told us that Xinyao Aluminum focuses on the processing of various types of door and window profiles. The company pays particular attention to product quality. When it first entered the Indonesian market, it targeted the mid-to-high-end profile sector, purchasing production equipment from China to ensure that product quality meets international standards. However, Mr. Wen also told us that Indonesian aluminum distributors are more likely to recognize some of the leading local companies when choosing mid-to-high-end aluminum materials. New mid-to-high-end brands need a considerable amount of time to establish themselves here. Therefore, the company currently implements a multi-brand strategy, highlighting quality in mid-to-high-end products and cost-effectiveness in mid-to-low-end products, allowing the company to quickly get on track.

Indonesia's urbanization process is accelerating, and the Indonesian government is preparing to relocate the capital from Jakarta to Kalimantan Island. This presents a huge market demand, and the demand for building materials is expected to continue to grow. However, the Indonesian market's recognition and acceptance of new brands are relatively slow. Chinese companies wishing to develop here need to be well-prepared," Wen analyzed.

During the visit, Alujiawang also visited several local door and window processing factories to learn more. Compared to the domestic door and window market, there are fewer door and window companies here, less competition, and lower rent and labor costs. The key is to have stable sales channels and customers. Qin, the head of Dinghao Windows, has been cultivating the Indonesian market for nearly 20 years. He told Alujiawang that the local door and window market is still in its infancy, with no well-known or competitive brands yet established. Product structures are mainly low-to-mid-range. When encountering customers with higher demands, he usually chooses to import directly from China.

"Generally speaking, local Indonesian households still mainly use old-fashioned wooden doors and windows, with aluminum doors and windows accounting for less than 40%. The prospects are still quite broad." Qin told Alujiawang.

Opportunities and Challenges: The Dual Aspects of the Indonesian Aluminum Market

As Indonesia follows China in embarking on a "large-scale infrastructure construction era" and pays close attention to the "green energy transformation," the Indonesian aluminum industry is expected to achieve rapid development within the next 5-10 years, becoming an indispensable part of the global aluminum supply chain. This will provide fertile ground for Chinese aluminum processing companies to explore overseas markets.

However, similar to many countries along the Belt and Road, the Indonesian aluminum industry is like a coin, with one side shining with alluring opportunities and the other side engraved with challenges that cannot be ignored.

Policy benefits are one of the most significant attractions of the Indonesian aluminum industry. The Indonesian government is vigorously promoting the green energy transformation, which has brought new growth points for the aluminum processing industry. Alujiawang discovered during its research that Jianye Energy Technology's photovoltaic frame products are in short supply, benefiting from the rapid development of the Indonesian solar energy industry.

The rapid growth of market demand is also encouraging. As Indonesia enters the "large-scale infrastructure construction era," investment in infrastructure such as construction, transportation, and electricity is continuously increasing, effectively driving the sustained growth of total aluminum consumption.

Greater profit margins continue to attract Chinese companies. Currently, the total number of aluminum processing companies in Indonesia is relatively small, and the industry has not yet entered a fully competitive market stage. Product premiums are generally much higher than in China. However, local aluminum processing companies also stated that the number of Chinese aluminum processing companies investing in and establishing factories in recent years has increased significantly. The future market changes remain to be seen.

Cost advantages are key to Chinese companies' decisions on overseas expansion methods. Indonesia has abundant local human resources, with ordinary workers' monthly salaries only equivalent to one-third or two-thirds of those in China, and the difficulty of recruitment is far less than in China. This is the primary consideration for many aluminum processing companies wanting to build factories locally; in addition, Indonesia is currently a developing country, and the costs of energy, land, and environmental protection are also significantly more advantageous compared to China; for export-oriented aluminum processing companies, Indonesia's export tariffs and sea freight costs are also much lower than in China.

Of course, not everything is advantageous. For companies already established locally, many of Indonesia's "shortcomings" cannot be ignored. The most prominent is the lack of professional talent. Language barriers and cultural differences further magnify this problem, often resulting in low communication efficiency between Chinese management personnel and Indonesian employees.

Supply chain shortcomings are also a significant problem plaguing Indonesian aluminum processing companies. In addition to aluminum ingots, the equipment, auxiliary materials, and parts required for production by Indonesian aluminum processing companies must be imported from countries like China. The procurement, transportation, and maintenance costs are far higher than in China.

In addition, insufficient infrastructure increases operational difficulties, cultural differences create management challenges, low administrative efficiency and government transparency… are all daily challenges that local Chinese and Chinese-funded aluminum processing companies need to address.

Post-Visit Notes

In general, the Indonesian aluminum processing industry gives the impression of being in a stage of "growing pains." Although there are many problems, the prospects are bright. With the entry of more Chinese companies and the improvement of the local industrial chain, many current shortcomings are expected to be gradually addressed. However, only those companies that truly understand the local market, respect the laws of development, and adhere to long-termism can succeed in this fertile land and jointly write a new chapter in the aluminum industry with Indonesian partners.

From "Alujiawang"

Prev: None

Next: Building materials industry quality brand building work plan and implementation plan

HOT NEWS